The First

Asset Accumulation

Model

QuantaamLab has developed the first digital asset wealth management platform with modular design architecture and Multi-AI Agent trade automation.

AAM Unique Selling Points

Purpose-built innovations that set the Asset Accumulation Model apart from traditional approaches.

IP Protection & 20+ Patent Eligibility

AAM Metrics framework with comprehensive intellectual property protection and patent-eligible innovations.

Proprietary Volatility-Leveraging Framework

Systematic exploitation of market volatility for consistent asset accumulation across all conditions.

Market Agnostic Performance

AAM delivers in both Bear and Bull market scenarios with 3-5x better accumulation in downturns.

AAM Turtle Effect

Measures incremental asset accumulation effect — slow, steady, and resilient wealth building.

AAM Snowball Effect

Exponential asset accumulation through compounding — your assets grow faster over time.

Black Swan Resilience

Built for resilience during Black Swan events, long-term recessions, depressions, and stagflation.

Alpha & Backtest Analytics

AAM alpha test phase performance and comprehensive backtest performance analytics.

Non-Custodial Wealth Management

Your assets remain in your custody — autonomous digital asset wealth management without intermediaries.

AAM Feature Suite

Non-Custodial Digital Asset Autonomous Wealth Management AI-Engine

Volatility as Opportunity

AAM recognizes that volatility creates price dislocations that can be systematically exploited to accumulate more assets over time, regardless of long-term price direction, using AAM Metric AVI & ASI.

Turtle Effect Index

Calculates asset accumulation with AAR%, SAAI & AAM-PI — measuring the steady, incremental growth of your asset portfolio over time.

Snowball Effect Index

Calculates asset accumulation progress with AAM eCOST & AAAQ — tracking the exponential compounding growth of accumulated assets.

Asset Selection

AI-powered metric for intelligent asset selection, evaluating technology, market cap, security ratings, user base, and development activity.

Composite Asset Performance Index

AAM Performance index for optimal strategy selection across multiple asset classes and market conditions.

AAM Risk Metric

Asset Quantity at Risk — a proprietary risk metric that quantifies potential asset quantity exposure in adverse market scenarios.

Multi-AI Agent System

Six specialized AI agents working in concert to deliver 24/7 autonomous asset accumulation with unprecedented efficiency and performance.

Asset Centric Reporting

Comprehensive AAM asset-centric reporting and analytics — tracking what matters most: your growing asset quantity.

Proprietary AAM Metrics

Purpose-built indicators for measuring asset accumulation performance

Identifies the best accumulation opportunities by measuring exploitable volatility.

Strategy-specific performance measurement for scalping-based accumulation.

Primary performance metric measuring percentage growth in asset quantity.

Overall strategy effectiveness score showing the multiplier of assets accumulated.

Your performance vs passive holding (HODL). Shows how much better AAM performs.

Forward-looking projections for annual asset accumulation targets.

Consistency measurement tracking steady, incremental accumulation over time.

Average purchase price tracking — your true cost basis for accumulated assets.

Risk metric quantifying potential asset quantity exposure in adverse scenarios.

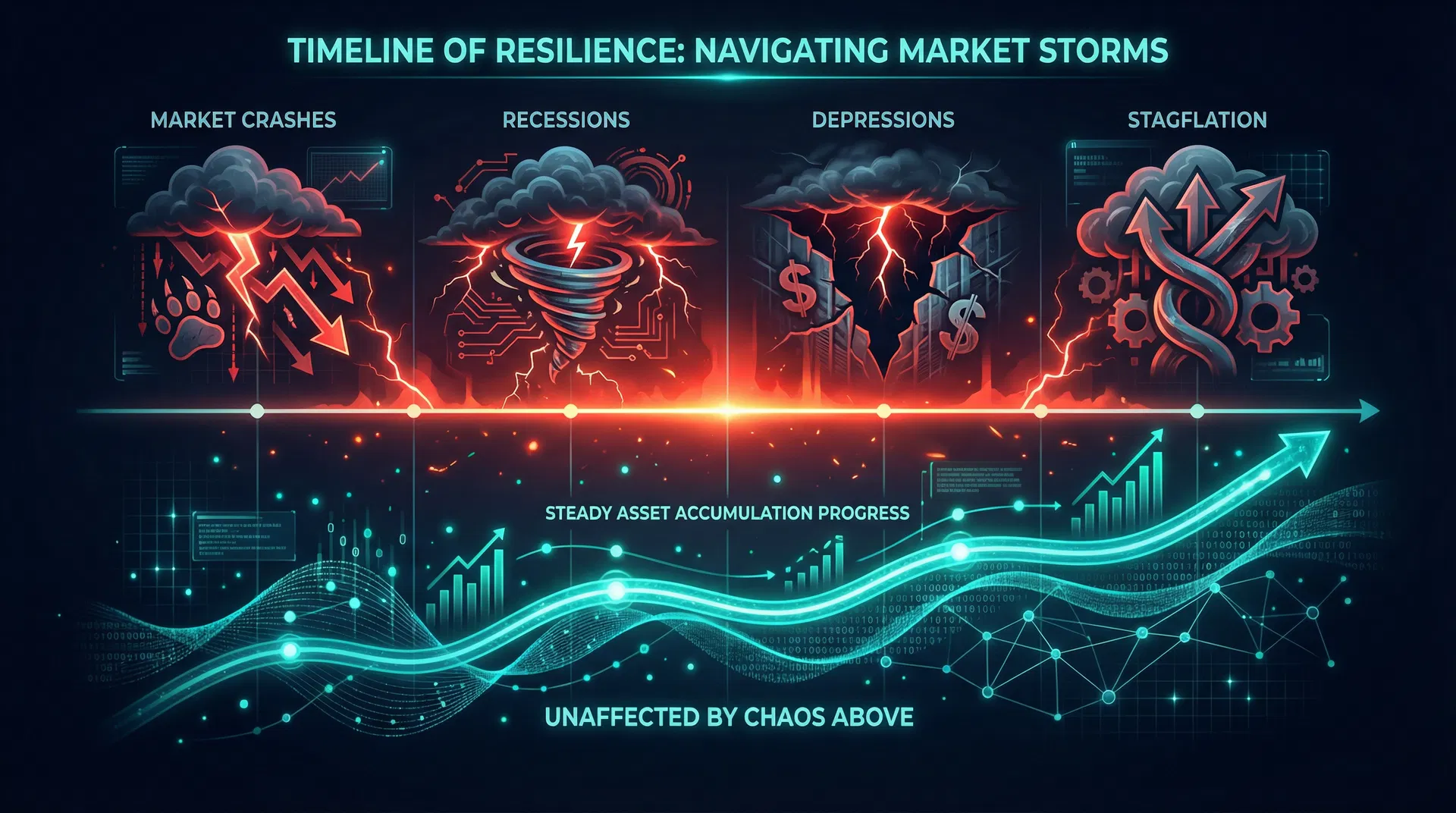

Built to Withstand the Unthinkable

While traditional strategies collapse during extreme market events, AAM transforms chaos into accumulation opportunity. Our framework is purpose-built for the scenarios others fear most.

The AAM Philosophy

"We don't just trade to make money — we trade to accumulate more assets."

Resilience Across Every Scenario

How AAM performs when markets face their most extreme conditions

Market Crashes

Flash crashes & sudden corrections

When markets plunge 30-60% in days, AAM's volatility-leveraging framework activates aggressive accumulation protocols. Lower prices mean more assets acquired per dollar — turning panic into opportunity.

Recessions

Prolonged economic downturns

During extended bear markets lasting months or years, AAM's Turtle Effect ensures steady, incremental accumulation. Each dip is systematically exploited while risk is managed through AQaR metrics.

Depressions

Severe & sustained market decline

In the most extreme downturns, AAM's non-custodial architecture ensures your assets remain in your custody. The Snowball Effect compounds accumulated assets, building positions at historically low prices.

Stagflation

High inflation + stagnant growth

When traditional assets erode under inflation and stagnation, AAM's market-agnostic approach continues accumulating digital assets. The AVI identifies exploitable volatility even in sideways markets.

Navigating Market Storms

While chaos reigns above, AAM maintains steady asset accumulation progress below

The Counter-Intuitive Advantage

AAM performs significantly better in bear markets — the opposite of traditional strategies

Bear Market

AAM's optimal environment

Lower prices = more assets per trade. AAM's volatility-leveraging framework thrives when others retreat. The Turtle Effect ensures consistent, incremental accumulation throughout the downturn.

Bull Market

Steady accumulation continues

Higher prices mean fewer assets per trade, but AAM still accumulates. The Snowball Effect compounds previous gains, and the AAAQ target continues to be met through strategic rebalancing.

Six Layers of Defense

AAM's multi-layered resilience framework ensures protection and continued accumulation under any market condition

Non-Custodial Architecture

Your assets never leave your wallet. No exchange risk, no counterparty failure. Even if platforms collapse, your accumulated assets remain safe in your custody.

AQaR Risk Quantification

Asset Quantity at Risk metric continuously monitors exposure. Unlike dollar-based risk metrics, AQaR measures the actual quantity of assets at risk, aligning with AAM's accumulation philosophy.

Multi-AI Agent Vigilance

Six specialized AI agents operate 24/7, monitoring market conditions, adjusting strategies, and executing trades autonomously — no human emotion, no panic selling, no missed opportunities.

CAPI Strategy Selection

The Composite Asset Performance Index dynamically selects optimal strategies for current conditions. Bear market? AAM shifts to high-frequency accumulation. Bull market? It locks in gains.

eCOST Anchoring

AAM Effective Cost tracking ensures your average purchase price continuously decreases through strategic dip-buying, building a cost basis that withstands even severe drawdowns.

IP-Protected Framework

20+ patent-eligible innovations protect the AAM methodology. This proprietary framework cannot be replicated, ensuring a sustained competitive advantage for AAM participants.

QuantaamLab AAM Ecosystem

A comprehensive suite of interconnected products powering the future of digital asset wealth management.

StrateFai

Digital Asset Wealth Management Platform

QuantFai

AAM R&D Hub, Digital Investment Fund & Treasury Backed Token

AACCUMA

Digital Asset AAM Markets Analytics & $AACCU Ecosystem Token

AAM.Foundation

AAM Innovation Hub, Education & Media

QuantaamDEX

AAM Decentralized Exchange

MyFai

AAM Ecosystem Analytical Dashboard

SocioFai

Community-Driven AAM Social DAO

OneQ

Hyper-Personalised AAM Private Investment Platform

CoinCADDY

Digital Asset Centric Portfolio Agents

CareFai

AAM Powered Decentralised Healthcare Fund

Ready to explore the AAM Ecosystem?

Access the comprehensive analytics dashboard and start analyzing asset accumulation performance across the entire QuantaamLab product ecosystem.